Create the perfect resume for a role in tax services

A tax services resume can often involve deciding what to cut as much as what to include. So make yours stand out in the crowd for any role with our top tips.

Tax services is a broad sector with numerous opportunities for passionate and skilled individuals. The ideal tax services resume will demonstrate that passion, along with a healthy dose of achievements and evidence of your skills.

Most people are well-aware of the resume basics, such as endeavoring to stick to one page wherever possible. Still, there are specific steps that people in the financial sector can take to ensure that their tax services resume stands out in the crowd.

Here are the best ways to take yours to the next level and give you every chance of landing your dream job.

Still looking for a job? These 100+ resources will tell you everything you need to get hired fast.

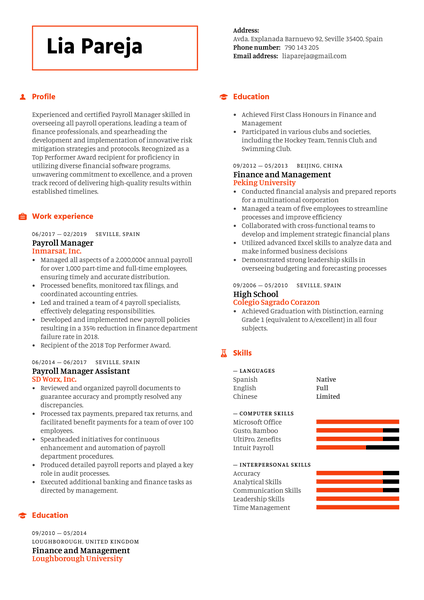

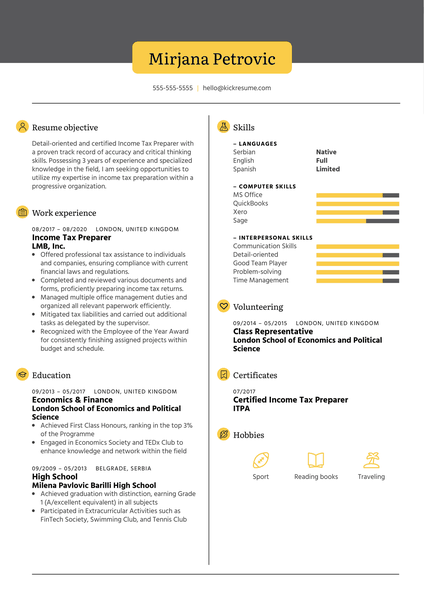

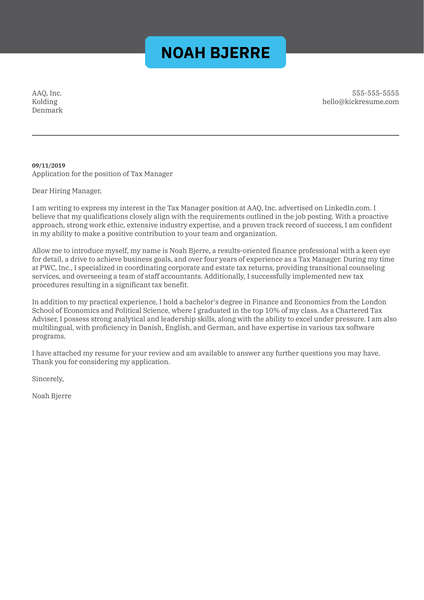

1. Always open with a professional profile

How would you describe yourself in four lines? That's probably not a difficult question for most people, but what if it changes to require you to define your entire education and employment history with the same space available?

That's what you need to do when you start a resume with a profile, resume summary, or career objective. However, it doesn't have to be as daunting as it sounds.

After all, people make a point of remembering the highlights. Of course, a few bad days might stick out, but those where it was just business as usual tend to evaporate from memory fairly quickly. As such, you don't need to include a blow-by-blow account of your working life, which is excellent news for people that are moving on after already establishing a successful career.

Counter to this, even if you're just starting out, you don't need to struggle along filling out four lines with history. A resume objective is often used by those with fewer than two years of experience in their chosen field, and it can come in handy when applying for tax services roles.

In these cases, by all means, shine a spotlight on your achievements thus far, even if they're not strictly relevant to the industry. They can take in school, part-time roles, jobs that are technically unrelated to the next step in your career, or volunteering. This resume section also provides candidates with the opportunity to talk about their goals and beliefs.

In doing so, they can demonstrate to a prospective employer that while there might be candidates on the shortlist with more remarkable experience, they have a plan for what they want to achieve in the job.

On the other hand, if you've got so much experience and have seen so many wins that it's difficult to condense it down into a profile, go with relevance and intrigue. For example, if you improved performance by 40% in one role and 60% in another, go with the latter simply because it has more chance of catching the eye. Recruiters like numbers, especially when they back up achievements, and bigger is almost universally better.

Remember to stick with the third person approach and don't feel like you have to be too humble about things you excel at.

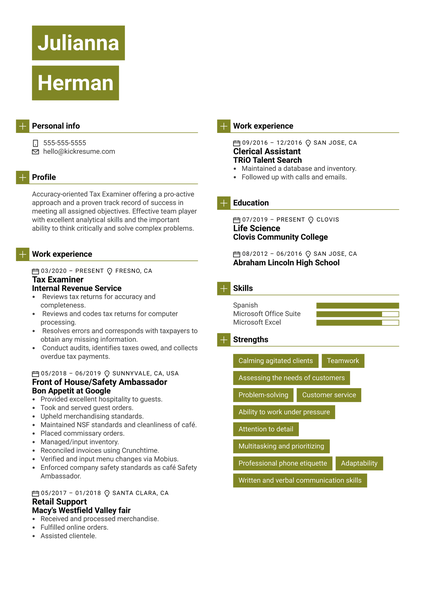

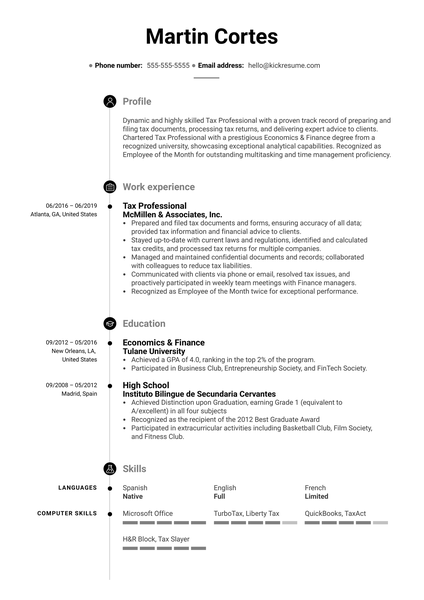

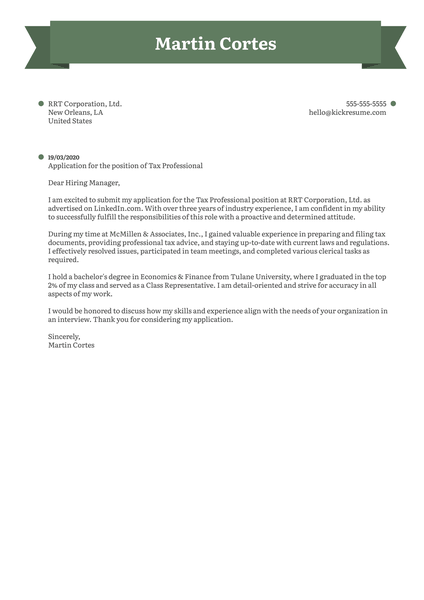

Tax services professional profile example

Accuracy-oriented Tax Examiner offering a pro-active approach and a proven track record of success in meeting all assigned objectives. Effective team player with excellent analytical skills and the vital ability to think critically and solve complex problems.

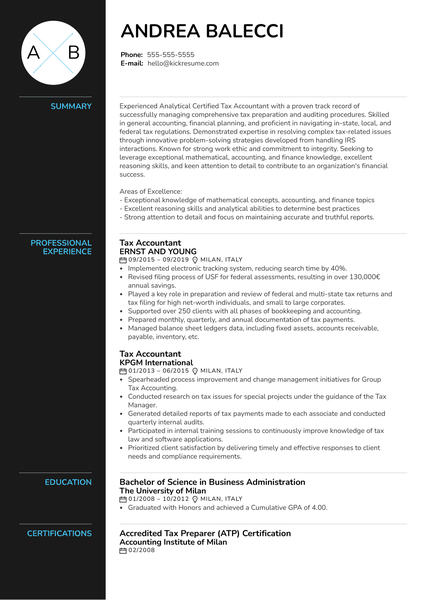

2. Adjust your tax services work experience section to suit the role

As noted, you don't have to discuss everything you've ever achieved in your profile summary. Instead, think of it as the appetizer, with your real-world work experience serving as the main course that will ultimately land you the role of your dreams.

One of the more challenging aspects of crafting a tax services resume is that there are so many different applications. You might have worked for businesses across multiple sectors or focused on government work – on both sides of the tax services coin. This can be a hugely varied career, and the thought of keeping an accurate resume down to one page can be daunting.

However, it all comes down to relevance.

Even if all you have to base that relevance on is the job description, you'll be able to gain a good idea of what it takes to succeed in it. You can even draw upon work experience from outside the tax world if you feel like it might enhance your resume.

For example, you might have worked in a call center, doing nothing to do with tax except paying it out of every check. If the role you're applying for requires experience speaking on the phone with external individuals, you've got an instant advantage over other potential applicants.

Essentially, you need to trim down your skills. It's often tempting to tell a prospective employer everything you're good at and reel off achievements like there's no tomorrow. However, while they surely want to know all about it, save that for the interview stage. In the meantime, decide what you've done and what you can do that suits the role and makes you a more attractive prospect than the next resume in the pile.

Tax services work experience section example

McMillen & Associates, Inc., Atlanta, GA, United States

Tax Professional

2016-2021

- Prepared and filed tax documents and forms, ensuring the accuracy of all data; provided tax information and financial advice to clients.

- Stayed up-to-date with current laws and regulations, identified and calculated tax credits, and processed tax returns for multiple companies.

- Managed and maintained confidential documents and records and collaborated with colleagues to reduce tax liabilities.

- Communicated with clients via phone or email, resolved any tax issues, and pro-actively participated in weekly team meetings with Finance managers.

- Awarded Employee of the Month twice for performing great work.

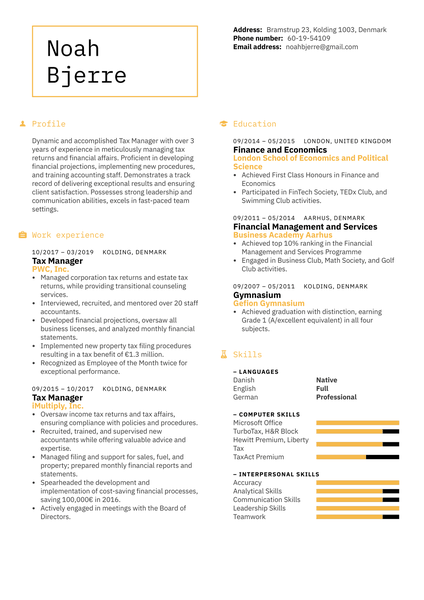

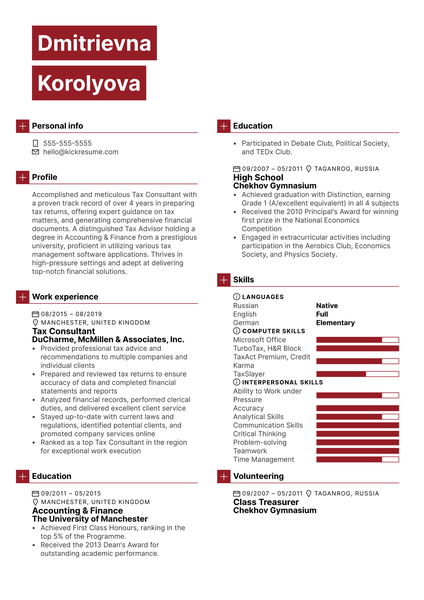

3. Strike a balance between experience and qualifications on your tax services resume

You don't necessarily need specific qualifications to operate in tax services. Experience can do a great job of filling in if you lack credentials, but it all comes down to striking a balance.

Think about what you can list by way of skills, experience, and formal education, and decide which stands the best chance of resonating with the employer. If you feel like your education will stand out compared to other applicants, give it the space to shine.

Conversely, if you don't have a degree and assume that other applicants will, make a bigger deal out of the experience you have that they might lack.

Education section example for a tax services resume

Tulane University, New Orleans, LA, United States

BA in Economics & Finance

2012-2015

- GPA: 4.0 (Top 2% of the Program)

- Clubs and Societies: Business Club, Entrepreneurship Society, FinTech Society

When it all comes down to it, your job is to prove to an employer that you're the perfect fit for the advertised role. You have complete control over your tax services resume and can decide which parts of your skills, experience, and education are prioritized. So tailor it to what you think the employer wants to see, back it up with facts wherever possible, and prioritize the parts of your experience that stand the best chance of landing you the job you want!

![How to Write a Professional Resume Summary? [+Examples]](https://d2xe0iugdha6pz.cloudfront.net/article-small-images/i-Profile.svg)

![How to Put Your Education on a Resume? [+Examples]](https://d2xe0iugdha6pz.cloudfront.net/article-small-images/i-Collage-Universities.svg)

![How to Describe Your Work Experience on a Resume? [+Examples]](https://d2xe0iugdha6pz.cloudfront.net/article-small-images/Experience.svg)